Ethena Labs is building a decentralized financial system by introducing a synthetic dollar protocol, USDe, built on the Ethereum blockchain.

This initiative aims to address the need for a stable and scalable form of crypto-native money, independent of traditional banking systems.

What is Ethena (ENA)?

Ethena (ENA) is the native token of the Ethena protocol. It serves a governance function, allowing token holders to vote on crucial protocol decisions.

As of March 29th, 2024, the total supply of ENA is capped at 15 billion, with an initial circulating supply of approximately 1.4 billion upon launch.

The Problem: The Need for Crypto-Native Money

Ethena argues that the crypto space lacks a truly decentralized base money asset. They point out that existing stablecoins, a crucial financial instrument, rely on traditional banking infrastructure. This creates a vulnerability to censorship and hinders scalability within a decentralized financial system.

Ethena’s goal is to provide a scalable, crypto-native form of money to enable a truly decentralized financial system. They believe this is essential for a functional system to operate at scale.

Here’s a breakdown of their reasoning:

- De reliance on Traditional Infrastructure: Stablecoins, currently a critical component of DeFi, are pegged to the US dollar and rely on traditional banking systems for collateral. This creates a single point of failure and exposes the system to potential censorship.

- The Need for a Decentralized Reserve Asset: Both centralized and decentralized order books require a stable, decentralized reserve asset to function effectively.

- Global Access to Savings Instruments: A significant portion of the global population lacks access to permissionless, dollar-denominated savings instruments.

The Solution: USDe – A Synthetic Dollar

Ethena proposes USDe, a synthetic dollar built on Ethereum, as the solution. USDe aims to be:

- Scalable: Achieved through the use of derivatives on staked Ethereum collateral.

- Stable: Maintained through delta-hedging mechanisms.

- Censorship Resistant: By keeping collateral outside the traditional banking system.

Here’s a deeper dive into USDe’s functionalities:

- The Internet Bond: Ethena aims to leverage USDe to create a “decentralized internet bond.”

- This bond would combine yield from staked Ethereum with additional returns generated from derivatives markets. This instrument would function as a dollar-denominated savings option for users.

How Ethena Addresses Challenges

Ethena acknowledges the limitations of existing stablecoin designs and proposes solutions through USDe:

-

Centralized Stablecoin Challenges: USDe aims to eliminate the counterparty risk and censorship concerns associated with centralized stablecoins by keeping its collateral outside the banking system. Additionally, USDe strives to provide embedded yield to users, unlike existing models.

-

Decentralized Stablecoin Limitations: Ethena believes existing decentralized stablecoin designs suffer from scalability limitations and lack of built-in yield generation. USDe aims to address these issues through its use of derivatives and staked Ethereum collateral.

Ethena’s Potential Impact

Ethena positions USDe as a significant development for the crypto space, offering the potential for:

- Enabling Ethereum as a Stable Form of Money: A stable, crypto-native dollar could attract significant capital inflows into both centralized and decentralized crypto ecosystems.

- The Largest Opportunity in Crypto: Ethena suggests that providing a permissionless, dollar-denominated savings instrument (internet bond) could be the biggest opportunity in crypto, offering benefits to users worldwide.

ENA Token and Tokenomics

ENA is the native utility token of Ethena Labs. It plays a crucial role in the Ethena ecosystem.

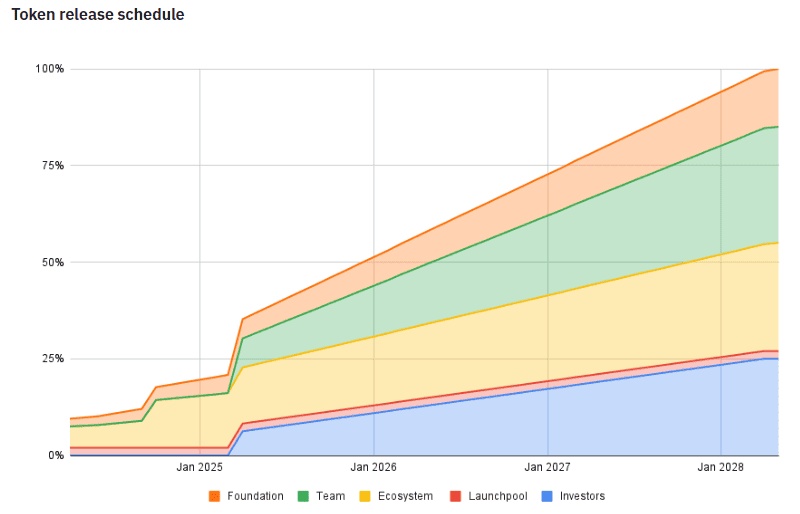

Token Distribution:

Ethena has allocated its total token supply across various categories, including:

- Binance Launchpool (2%)

- Investors (25%)

- Team (30%)

- Foundation (15%)

- Ecosystem (28%)

Why Ethena Matters

Ethena’s vision extends beyond just offering a stablecoin. They believe a decentralized, permissionless savings instrument like the Internet Bond has the potential to be:

- Globally Accessible: Providing a way for people worldwide to earn a yield on their savings, regardless of location or financial standing.

- A Boon for DeFi: A reliable, censorship-resistant stablecoin like USDe can serve as a cornerstone for a truly decentralized financial system.

- A Catalyst for Crypto Adoption: By removing the reliance on traditional finance, Ethena can help accelerate the mainstream adoption of cryptocurrencies.

Ethena Labs has the potential to significantly impact how we interact with money in the digital age. The idea of having a stable, decentralized currency like USDe, which is fully backed and transparently managed on the blockchain, is particularly appealing. It promises to reduce our reliance on traditional banks and financial systems, which can be exclusive and restrictive.

As for use cases, USDe could become a go-to digital currency for everyday transactions, remittances, and a safe haven asset, much like the US dollar, but with the added benefits of blockchain technology.

Participating in the Binance Launchpool

Ethena recently launched its ENA token on Binance Launchpool, the platform’s innovative token launchpad.

By staking BNB or FDUSD tokens on Binance Launchpool, users can earn ENA tokens as rewards. This is a great opportunity to participate in the Ethena ecosystem and potentially benefit from its growth.

If you don’t already have a Binance account, you can create one using this link.

To dive deeper into the technical details and the team behind Ethena Labs, we highly recommend checking out their research page on Binance.

It provides an in-depth look at the project’s goals, technology, and roadmap. You can find it here: Binance Research – Ethena Labs