Key Points

- Bitwise updated its S-1 form for Ethereum ETF, including $2.5 million seed investment data.

- New predictions claim ETH ETFs could launch before July 4.

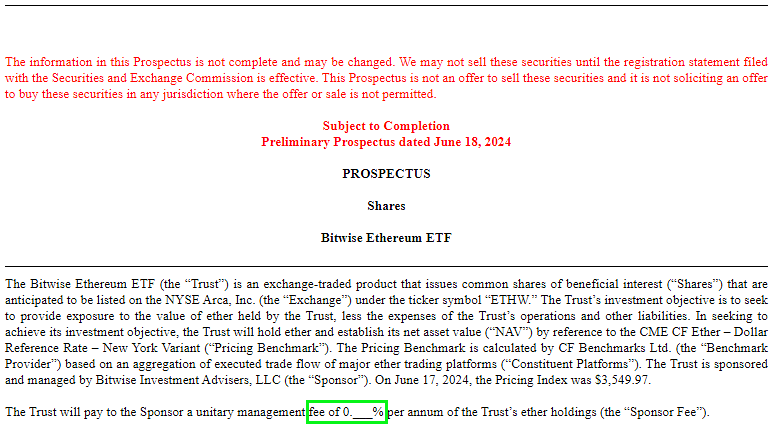

According to the latest official reports, Bitwise has updated its S-1 form for the Ethereum ETF application with the SEC.

Among other ETH ETF issuers, the firm is awaiting for the SEC’s green light regarding the launch of the crypto products.

Bitwise included new details in the updated S-1 form about a $2.5 million seed investment. The product’s fees are not disclosed yet.

The firm said that Bitwise Investment Manager, LLC, an affiliate of the Sponsor, is expected to purchase the initial Baskets of Shares for $2.5 million at a per-share price of $25 for these 100,000 shares.

Bitwise also said that Pantera Capital Management LP is interested in buying up to $100 million worth of shares.

The asset management firm also said that due to the fact that indications of interest are not binding agreements or commitments to purchase, these potential purchasers could determine to purchase more, fewer, or no shares.

Bitwise is the latest firm to reveal an updated S-1 form after the SEC approved the 19b-4 forms for 8 Ethereum ETFs back in May.

Now, issuers for ETH ETFs are still waiting for the launch of the crypto products which is set to come following the SEC’s nod.

Ethereum ETFs could launch before July 4

Bloomberg’s analyst James Seyffart noted in a recent post on his X account that there is no way to know when the listings will eventually launch based on the filing by Bitwise.

According to him, these might not require additional updates, or, they could require some tweaks. But what is certain is the fact that they need the final nod from the SEC.

He said that launching time will be mostly up to the regulators, and together with Eric Balchunas (another Bloomberg analyst) they believe that the crypto products should launch before July 4.

Regarding the crypto products in the US, recently we reported that Hashdex just dropped a dual Ethereum and Bitcoin ETF filing.