For over a year, the U.S. Federal Reserve has kept interest rates at their highest levels in two decades, aiming to combat inflation. In his recent speech at Jackson Hole, Federal Reserve Chairman Jerome Powell hinted at the possibility of rate cuts starting in September. Analysts believe that as interest rates decrease, more liquidity is likely to flow into the cryptocurrency markets, potentially driving up prices. However, the initial market optimism was quickly tempered as leveraged positions led to liquidations, putting downward pressure on prices.

Ethereum’s Summer Slowdown

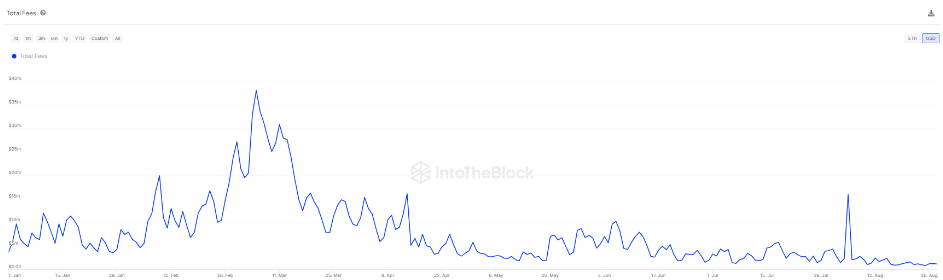

Traditionally, the summer months have seen a decline in trading activity for Ethereum. Over the past five years, ETH spot volumes in August have typically decreased by about 16.8% compared to the previous three months. This trend continued this year, with the average transaction fee on the Ethereum network reaching an all-time low of 0.000405 ETH last week.

The reduction in transaction activity has also led to a decrease in the amount of ETH being burned. The total ETH burned dropped by 22%, from 17,000 ETH in July to 13,000 ETH in August. This decline in activity mirrors a broader slowdown across the crypto market, including on networks like Solana, where the initial excitement around memecoins has faded.

Significant Ethereum Movements Amid Volatility

On Friday, August 23rd, a notable transfer of 715,000 ETH, valued at $1.9 billion, occurred after these funds had remained untouched for two years. This significant movement coincided with a period of high volatility for Ethereum, which has seen its volatility reach 69% year-to-date. The last time such a large amount of ETH was transferred was on June 11, 2024, when 719,000 ETH changed hands.

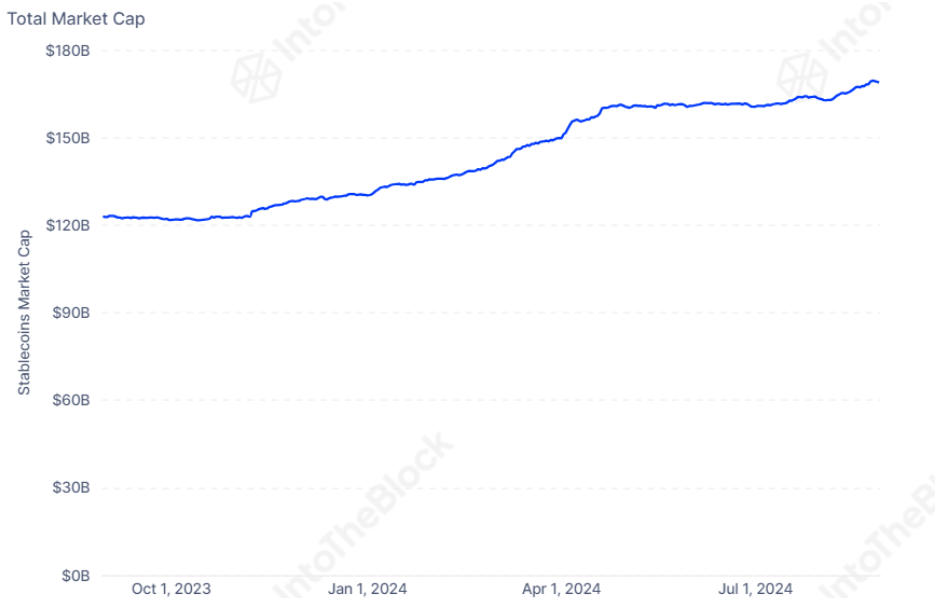

The Steady Growth of the Stablecoin Market

Despite the overall sideways movement in the crypto market, the stablecoin market has continued to grow, with the total market cap reaching $169 billion. This steady growth indicates increasing investor confidence in the crypto space, as stablecoins serve as a crucial bridge between traditional finance and the blockchain world.

Wyoming is moving forward with plans to launch a U.S. dollar-backed stablecoin called the Wyoming Stable Token. Similarly, PayPal’s stablecoin, PYUSD, has recently surpassed a $1 billion market cap, becoming the fifth-largest stablecoin in the market. PYUSD has gained popularity within decentralized finance (DeFi) protocols on the Solana blockchain.