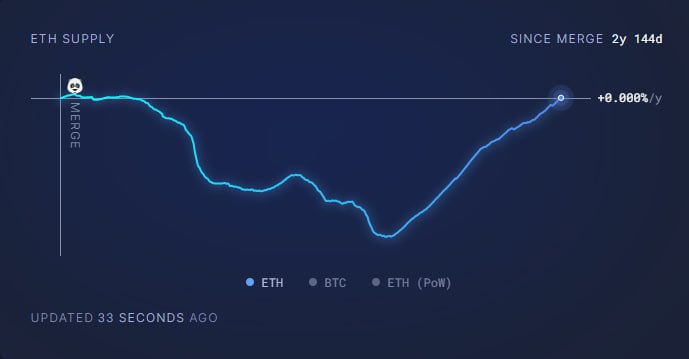

Ethereum’s total supply has reached 120,521,523 ETH, marking its highest level since January 2023 and matching pre-Merge supply levels, according to ultrasound.money.

This increase follows the Dencun upgrade in March 2024, which introduced changes that have reduced the amount of ETH being burned.

Why Is Ethereum’s Supply Increasing?

Impact of the Dencun Upgrade

The Dencun upgrade introduced blob transactions, designed to optimize data handling, especially for Layer 2 (L2) scaling solutions. Unlike traditional transactions, blob transactions use a separate fee unit (“blob gas”) that does not contribute significantly to ETH burning.

- Before Dencun, transaction fees were partially burned, reducing the overall supply.

- With more activity shifting to blob transactions, the proportion of fees burned has declined.

- As a result, Ethereum’s net supply has started increasing instead of decreasing.

Migration to Solana and Layer 2s

- The recent memecoin rally has drawn users and liquidity toward Solana, reducing Ethereum’s on-chain activity.

- Several new Ethereum L2 networks launched after Dencun, further diverting transactions away from the Ethereum mainnet, affecting gas fee burns.

Is This a Concern for Ethereum?

According to Presto Research analyst Jaehyun Ha, while the supply increase is not an immediate concern, it challenges Ethereum’s “ultrasound money” narrative—the idea that ETH is a deflationary asset superior to Bitcoin as a store of value.

Additionally, the upcoming Pectra upgrade, expected later in 2025, could further increase the blob transaction limit, potentially accelerating inflation.

On the security front, DeSpread researcher Byoungjoon Kim warns that a prolonged increase in ETH supply may weaken network security under the Proof-of-Stake (PoS) model, where ETH price is directly tied to economic security incentives for validators.

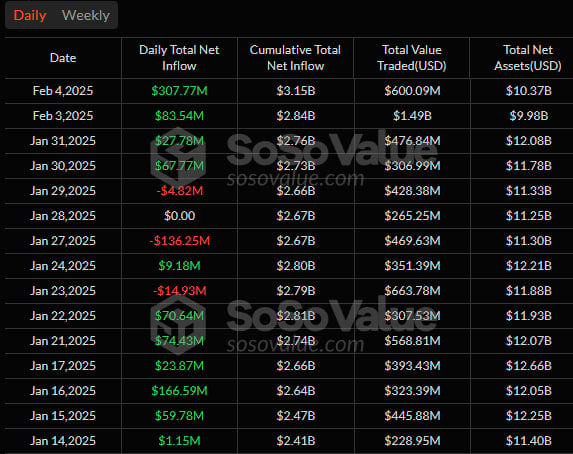

Ethereum ETF Inflows Continue

Despite the rising supply, institutional interest remains strong, according to SoSoValue data.

- On February 4, Ethereum spot ETFs saw a net inflow of $308 million, marking four consecutive days of positive inflows.

- Bitcoin spot ETFs also saw significant activity, with $341 million in net inflows, including $249 million into BlackRock’s IBIT fund.

The coming months will be critical for Ethereum, as inflation concerns, network upgrades, and governance debates shape its future trajectory.