Key Points

- On March 26, the US DoD alleged that KuCoin founders had failed to maintain an Anti-Money Laundering program at the exchange.

- DoD alleged that the exchange was used for “money laundering and terrorist financing.”

- KuCoin is deemed “fine” by CryptoQuant’s CEO despite concerns.

The other day, more reports on X platform triggered panic among KuCoin users, revealing that the US Department of Justice alleged that KuCoin founders ChunGan and Ke Tang failed to maintain an Anti-Money Laundering program at the exchange.

In the official announcement, the US DoD stated that the US Attorney for the Southern District of New York and the Acting Special Agent in Charge of the New York Field Office of Homeland Security Investigations announced the unsealing of an indictment against KuCoin.

According to the notes, two of the exchange’s founders, Chung Gan and Ke Tang, are accused of “conspiring to operate an unlicensed money transmitting business and conspiring to violate the Bank Secrecy Act.”

The notes continued and explained that they allegedly did this, by willfully failing to maintain an adequate AML program designed to prevent the exchange from being used for money laundering and terrorist financing.

CryptoQuant CEO says KuCoin is “fine”

Although the announcement triggered panic among users and the crypto community on X, Ki Young Ju, the founder and CEO of crypto analytics service CryptoQuant, said that the exchange is doing just fine.

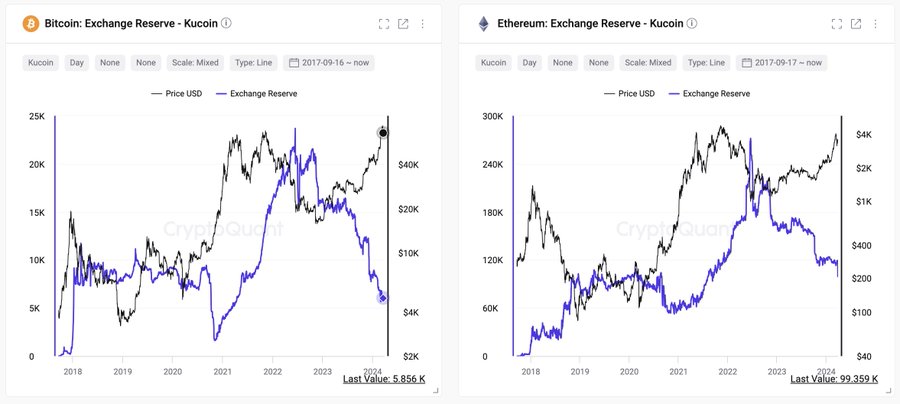

He explained that on-chain, the situation of KuCoin is fine, with BTC and ETH withdrawals surge driven mostly by retail users. But this had a very small impact on the overall reserves.

On-chain wise, @kucoincom is fine.$BTC and $ETH withdrawals surged, driven mainly by retail users, with a small impact on the overall reserve.

They appear to not commingle customers' funds and have sufficient reserves to process user withdrawals. pic.twitter.com/p4bJJpwnFJ

— Ki Young Ju (@ki_young_ju) March 27, 2024

He also made a comparison between KuCoin and FTX, stating that KuCoin’s BTC and ETH reserves appear organic, unlike the ones of FTX, without any signs of meddling with customers’ funds.

The challenges that KuCoin is facing are not unique to the exchange; they are simply typical growth and regulatory issues that are usually encountered by emerging industries, according to the KuCoin CEO:

The challenge we're facing is not unique to KuCoin but rather typical growth and regulatory issues encountered by emerging industries. Early-stage development often sees regulatory gaps, but as the industry matures, we move towards and embrace compliance and standardization.

— Johnny_KuCoin (@lyu_johnny) March 27, 2024

Here’s what the exchange declared:

#KuCoin is operating well, and the assets of our users are absolutely safe. We are aware of the related reports and are currently investigating the details through our lawyers. KuCoin respect the laws and regulations of various countries and strictly adheres to compliance…

— KuCoin (@kucoincom) March 26, 2024

Regulatory gaps are normal in the crypto industry, but the right steps are already being taken towards better compliance and standardization of the industry. As an example, we have the new EU AMLR decisions that are supporting and beneficial for the crypto industry, contrary to the latest rumors.

The latest EU Anti-Money Laundering Regulation was also surrounded by a lot of misinformation when, in fact, the most important points made by the new regulation represent a great outcome for the industry.