Key Points

- ONDO leads the top of RWA coins, with the entire sector gaining momentum.

- The move in prices comes after BlackRock’s announcement.

- BlackRock’s new initiative is called the BlackRock USD Institutional Digital Liquidity Fund, and it’s developed in partnership with Securitize.

BlackRock’s one-chain initiative seems to have been enough to pump the whole RWA category the other day.

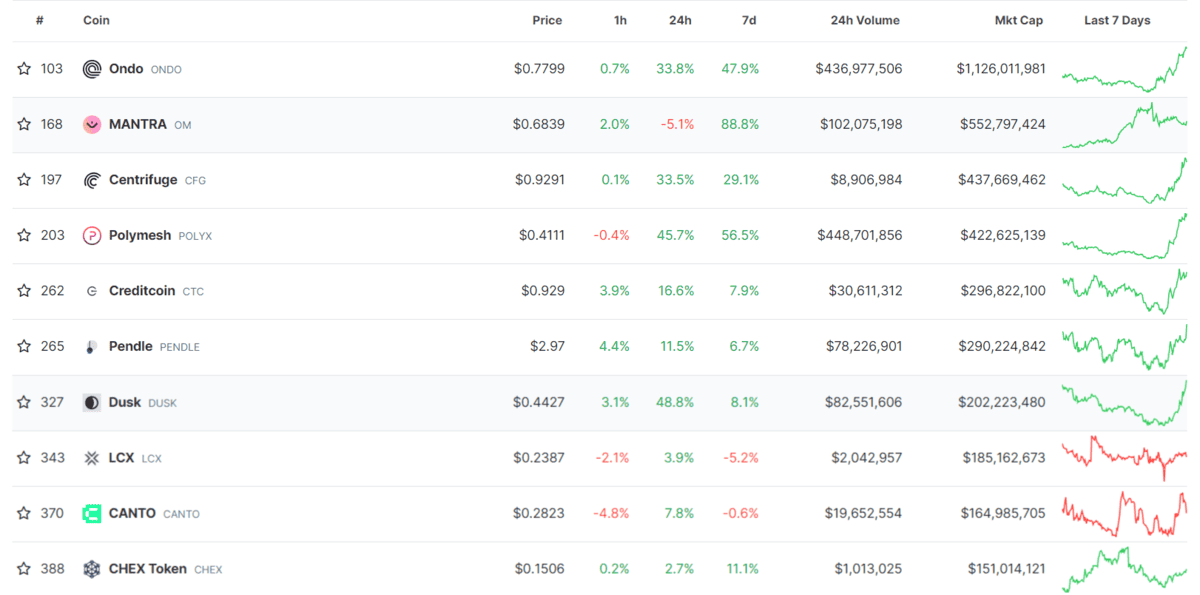

The most important coins in the top RWA are still surging in price, as you can see in the chart.

ONDO is the leader, and at the moment of writing this article, the coin is trading in the green, and it’s priced at $0.8, up by almost 39% in the past 24 hours.

On Thursday, ONDO briefly reached a new all-time high price point as the overall crypto market showed signs of quick recovery following the Federal Reserve’s second policy meeting of the year.

ONDO is the native token of Ondo Finance, a tokenized real-world asset (RWA) platform that aims to make institutional-grade financial products and services “available to everyone.”

The token was launched on January 18 with a market cap of $150 million and a fully diluted valuation of $870 million.

The pump in RWA sector follows BlackRock’s announcement

The RWA market is DeFi is small but vibrant, and the other day, it saw a surge in most of the coins following BlackRock’s announcement.

The world’s largest asset manager by assets under management has just submitted a form to the U.S. SEC for its initiative called the BlackRock USD Institutional Digital Liquidity Fund using Ethereum.

This feels very important for $Eth!!! https://t.co/UJVnIhm5pJ

— Mike Novogratz (@novogratz) March 19, 2024

The fund is registered in the British Virgin Islands in partnership with Securitize, a San Francisco-based company.

The details of the new fund are revealed in a new March 19 SEC filing.

On-chain data shows that the fund is seeded with an initial capital of $100 million on the Ethereum blockchain.