Key Points

- Australia’s top exchange, ASX Ltd., could approve the first batch of Bitcoin ETFs by the end of the year, according to Bloomberg.

- The move would mirror the US and Hong Kong’s decisions.

According to the latest reports from Bloomberg, Australia could follow in the footsteps of the US and Hong Kong and issue the first batch of Bitcoin ETFs by the end of 2024. Issuers such as Van Eck Associates Corp. and BetaShares Holdings Pty are in line for the listing.

ASX Ltd. reportedly handles about four-fifths of Australia’s equity trading and could approve the first spot Bitcoin exchange-traded funds before the end of this year, Bloomberg notes, citing sources familiar with the matter.

The Bitcoin ETFs applications come following US’ approval of BTC ETFs at the beginning of this year which included important names such as BlackRock and Fidelity Investments. BlackRock’s Larry Fink addressed their spot BTC ETF product, IBIT, and called it the fastest-growing in history following its huge success.

Hong Kong is also due to begin trading BTC and ETH ETFs tomorrow, April 30, and issuers are seeking to capitalize on a significant rebound that took Bitcoin close to $74k last month.

BetaShares, based in Sydney, is working towards launching a BTC ETF on ASX, and DigitalX Ltd. also submitted an application, according to Bloomberg. In February, VanEck resubmitted their own application back in February.

ASX revealed that the exchange continues to engage with various issuers interested in approving crypto ETFs.

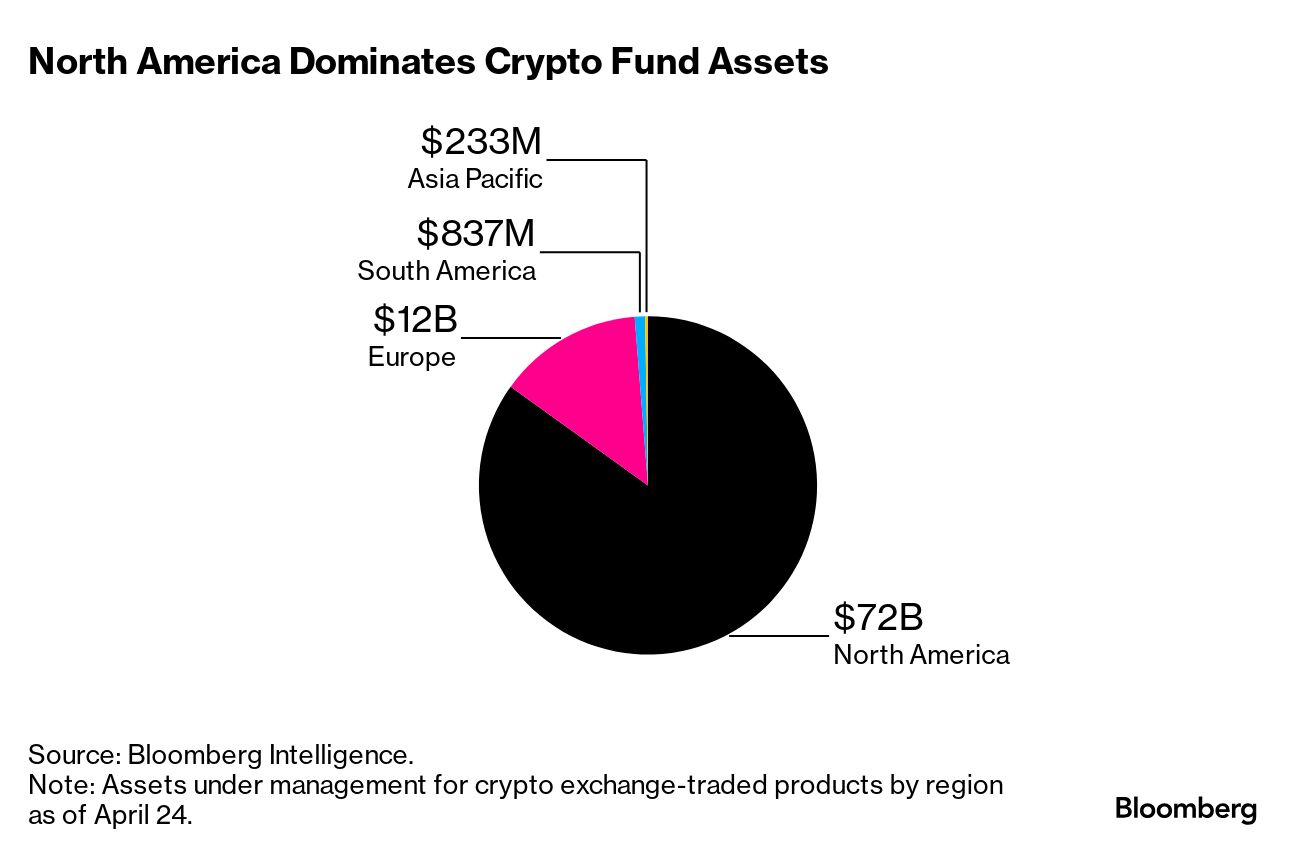

Bloomberg highlights that North America is dominating crypto fund assets with $72 billion. Europe comes next with $12 billion, followed by South America with $837 million, and Asia Pacific with $233 million.

Australia’s $2.3 trillion pension market could become an inflow catalyst

Australia’s $2.3 trillion pension market could help in driving inflows in crypto-based products. Approximately a quarter of the country’s retirement assets are sitting in self-managed superannuation programs that allow people to choose their investments.

These could emerge as buyers of crypto ETFs, Jamie Hannah, deputy head of investments and capital markets of VanEck Australia, believes.

She added that considering the self-managed super funds, brokers, financial advisers and platform money, there’s a significant market in the country to boost the ETF to a considerable size.

Australians could allocate 10% of portfolios to crypto, considering their potential as “financial rails,” as DigitalX CEO Lisa Wade states.