Key Points

- Bitcoin is trading above $69k following the CPI data released today.

- The new CPI report released today shows an increase of 3.3% from a year ago, unchanged in May.

Bitcoin’s price raced above $69k following the latest CPI report that showed an eased inflation.

- Zoom

- Type

The CPI report just came out showing an increase of 3.3% from a year ago, remaining unchanged in May.

This is a 0% month-over month inflation for the first time since August 2022.

Core CPI inflation fell to 3.4%, below expectations of 3.5%.

❖ U.S CPI (MOM) (MAY) ACTUAL: 0.0% VS 0.3% PREVIOUS; EST 0.1%

❖ U.S CPI (YOY) (MAY) ACTUAL: 3.3% VS 3.4% PREVIOUS; EST 3.4%

❖ U.S CORE CPI (MOM) (MAY) ACTUAL: 0.2% VS 0.3% PREVIOUS; EST 0.3%

❖ U.S CORE CPI (YOY) (MAY) ACTUAL: 3.4% VS 3.6% PREVIOUS; EST 3.5%

— *Walter Bloomberg (@DeItaone) June 12, 2024

It seems that inflation slightly loosened its grip on the U.S. economy, the Labor Department reported Wednesday. This weaker inflation could open the door to a July rate cut by the Fed, according to analysts.

The consumer price index was expected to increase 0.1% on a month basis and 3.4% from a year ago, according to Dow Jones consensus estimates.

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

The fixed 30-year mortgage lending rates for 80% loan-to-value mortgage data shows 7.02% compared to the previous 7.07%.

Today was an important day in finance and economic news as investors have been bracing about the path of inflation and the manner in which the Federal Reserve was going to react.

As noted earlier by CNBC, the day packed months of macro risk into one day, according to UBS economist Jonathan Pingle.

FOMC members have been working on finalizing their projections for inflation, gross domestic product, and unemployment as showing the expected rate path through 2026 and beyond.

The quarterly updates to the Summary of Economic Projections are most likely influenced by the CPI report.

Crypto markets saw high volatility ahead of the CPI data

Earlier, ahead of the CPI data, the crypto markets saw high volatility with BTC dropping below $67,000 before a quick rebound in price. Optimists were hoping for moves within the realm of expected outcomes.

According to Barron’s notes, economists surveyed by Factset were expecting to see inflation growing by 3.45 YoY in May, or at the same rate as in April.

Economists expected that the monthly pace of inflation slowed down to 0.1% last month, down from a growth rate of 0.3% in April.

The Core CPI excludes the more volatile energy and food prices and it’s considered a better gauge of inflation’s future path. This metric was earlier expected to slow at a rate of 3.5% from the 3.6% YoY pace logged in April, according to the same notes.

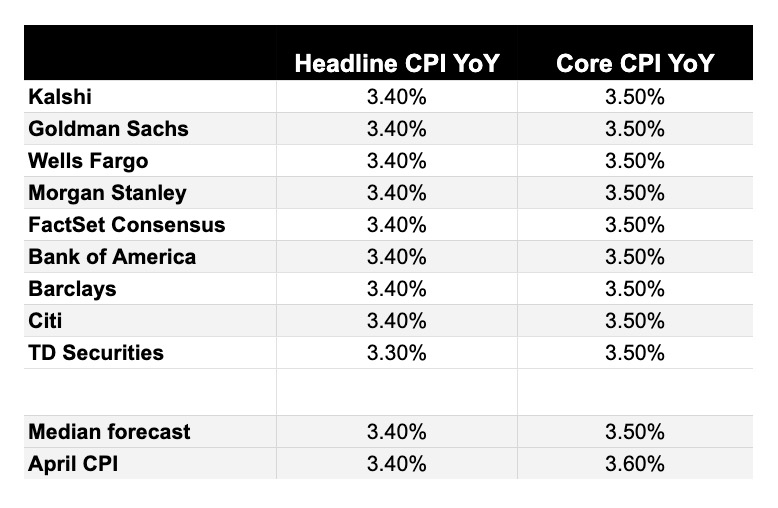

May CPI inflation expectations varied among financial entities. Most of them expected a 3.4% CPI inflation, in line with April’s numbers.

Here are the expectations that were coming earlier from Goldman Sachs, Kalshi, Wells Fargo, Morgan Stanley, Barclays, Bank of America, FactSet Consensus, Citi, and TD Securities.

Regarding Bitcoin’s correlation with equities, according to the CME’s FedWatch tool, interest rate traders speculate that the Fed may maintain rates until November.

The tool suggests a 47% chance that the Fed will keep the rates at their current levels during the Federal Open Market Committee (FOMC) meeting in September.

Deribit CEO Luuk Strijers noted that Bitcoin has been showing a higher-than-usual correlation with risk assets, including gold.