Key Points

- Bitcoin is trading above $61k following a dip below $59k on June 24.

- BTC miners are reportedly on a selling spree to pay for hardware upgrades to boost profits.

Bitcoin’s price saw a recovery following yesterday’s drop below $59,000. At the moment of writing this article, BTC is trading above $61,000.

- Zoom

- Type

Bitcoin’s recent price drops are caused by the miner capitulation event post the halving, according to Bitcoin on-chain analyst Willy Woo.

Today, Woo shared a thread on his X account, explaining once more what has been causing BTC’s price to see corrections during the past weeks.

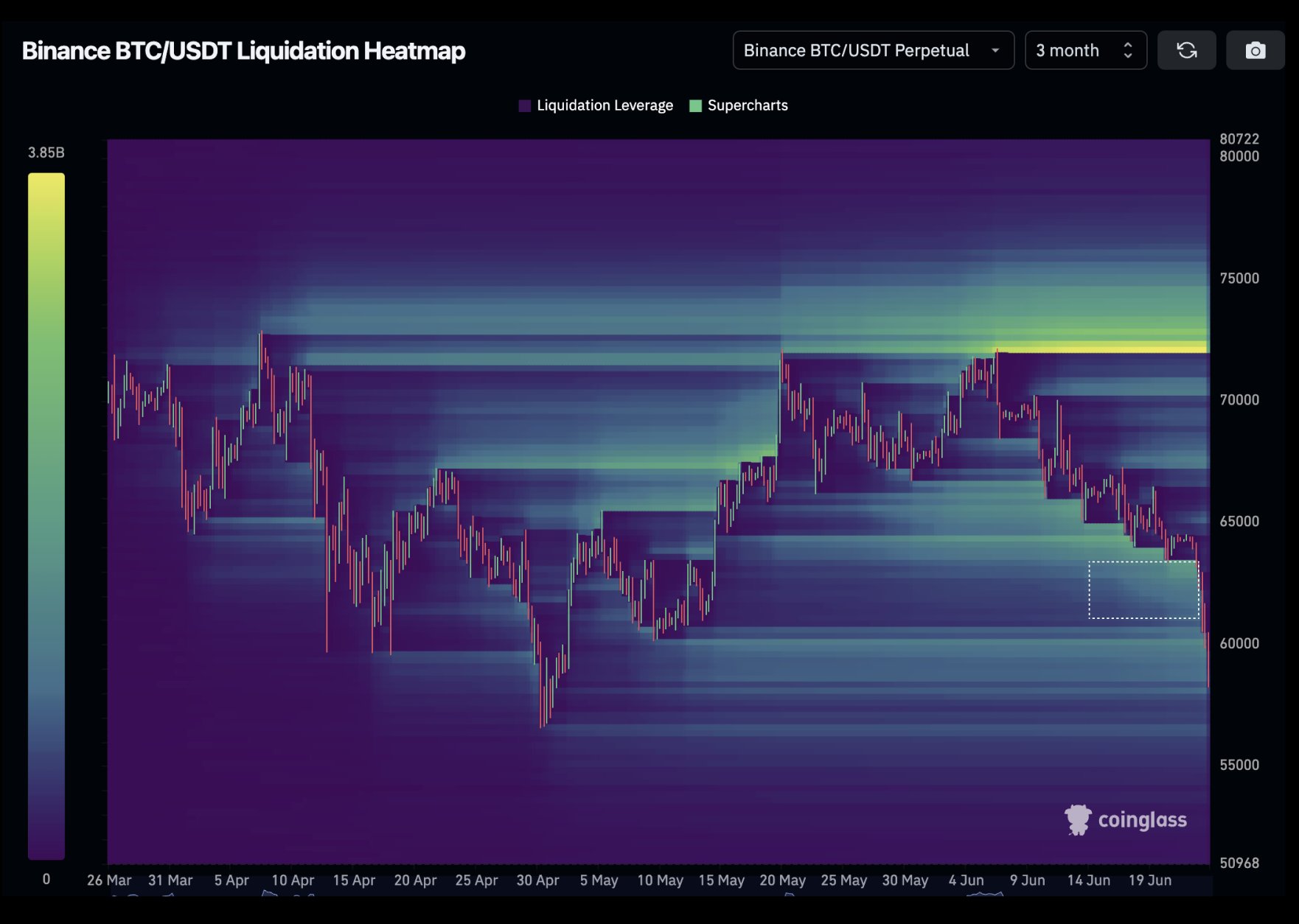

He said that given the fear in the market, it’s worth explaining what’s happening once more. According to him, the market has been flushing out the leverage and $62,500 was the target to get most of it.

Speculators kept adding to new long positions, this way putting more fuel for liquidations in a cascading long squeeze, bridging BTC down to the $58,000 cluster that has been taken out.

BTC miners are on a selling spree to enhance hardware

Woo also said that there is a post-halving miners’ capitulation during which miners are on a BTC selling spree to pay for hardware upgrades due to their old hardware no longer being profitable. The weakest miners are closing shop, and are being liquidated according to him.

The analyst also said that after the liquidations come to an end, BTC will not be out of the weeds yet, because we have to see how much speculation got cleared out of the system.

Without purging futures open interest, the system is not ready to move up.

Woo reiterated the idea that a miners’ capitulation is one of the highest reliability indicators for a subsequent rally, ending periods of sideways or bearishness. He said that this is a waiting game for the hash rate to claim and for the futures casino to subside.

According to him, too many bets mean too much synthetic supply flooding the market.

Bitcoin miners have been recently shifting their attention to AI in order to boost their systems and enhance revenues.