Key Points

- Bitcoin faces an inevitable price breakout, with a new S2F price target at $454k.

- Now, BTC continues to trade above the important $69k mark.

Bitcoin is currently trading above the important level of $69,500, up by over 2% in the past 24 hours.

- Zoom

- Type

More reports and price predicitons suggest that we should expect to see a huge price breakout for the coin.

Matrixport just shared a post via X, noting that BTC will see a breakout in its price, and the market will record a large move.

They mentioned that during the past week, $5.2 billion worth of BTC and $3.1 billion worth of ETH were moved off exchanges. Historically, this has been a bullish sign as the coins were moved back into cold storage and were not intended to be sold immediately anymore.

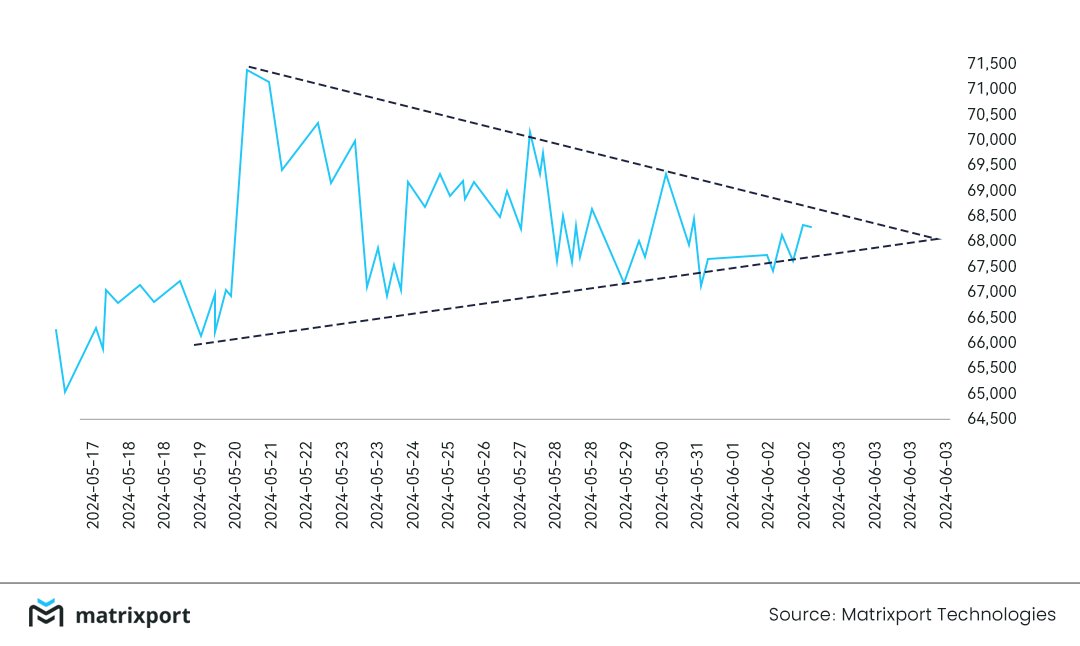

Matrixport also shared the following graph for Bitcoin, noting that we will soon see BTC breaking the triangle:

PlanB’s new S2F model suggests a $454k price target for BTC

PlanB also shared optimistic predicitons for the price of Bitcoin via his X account. He noted that Bitcoin’s 200-week moving average is now $36k, and rising. He highlighted the red dot and said that we should brace for a significant price rise, according to his graph.

PlanB also noted that an older $532 price target was based on the original 2019 stock-to-flow model: BTC=0.4*110^3=~532k. Now, he said that the recently refitted S2F model (with 5 years of new data since 2019) has similar results: BTC=0.25*122^3=~454k.

532k target was based on (original 2019) stock-to-flow model: BTC=0.4*110^3=~532k

The recent refitted S2F model (with 5 years new data since 2019) has similar results: BTC=0.25*122^3=~454k

— PlanB (@100trillionUSD) June 3, 2024

The ‘Stock-to-flow’ is a number that shows how many years, at the current production rate, are required to achieve the current stock. The higher the number, the higher the expected price.

BTC surges in anticipation of ECB’s expected rate cut

BTC’s price continues to rise ahead of the European Central Bank’s expected rate cut this week.

With recent drops in inflation, the ECB is predicted to lower its benchmark rates. Money markets suggest a 93% chance of an ECB rate cut in the upcoming monetary policy meeting.

Bitcoin is often seen as a hedge against inflation. If the ECB rate cut raises inflation expectations, it could potentially attract more investment as it is considered “digital gold”.