Key Points

- Peter Brandt predicts Bitcoin could surge 230% against gold in 12-18 months.

- Willy Woo reveals gold vs. BTC inflation graph.

Veteran trader Peter Brandt shared a post via his X account, highlighting that since its inception, Bitcoin has gained against gold. He believes that the ratio could “chop” for another 12 to 18 months, and then advance to 100 oz of GC to buy a BTC.

The current BTC/GLD ratio sits around 29, and this means that it takes 29 ounces of gold worth $68,000 to buy one Bitcoin. According to Brandt, this ratio could triple to 100 ounces after the Bitcoin consolidation phase comes to an end.

Brandt has been bullish on Bitcoin vs. Gold for a while now. Since the creation of Bitcoin back in 2009, the coin has massively outperformed the traditional haven asset, gaining more than 375,000% against gold.

The trader believes that Bitcoin still has enough room to run versus gold despite the already massive gains. His BTC/GLD ratio chart shows Bitcoin’s long-term uptrend against gold with enough room to advance.

Gold inflation vs. Bitcoin inflation

Willy Woo also addressed the gold matter, but he does it in mining progress terms.

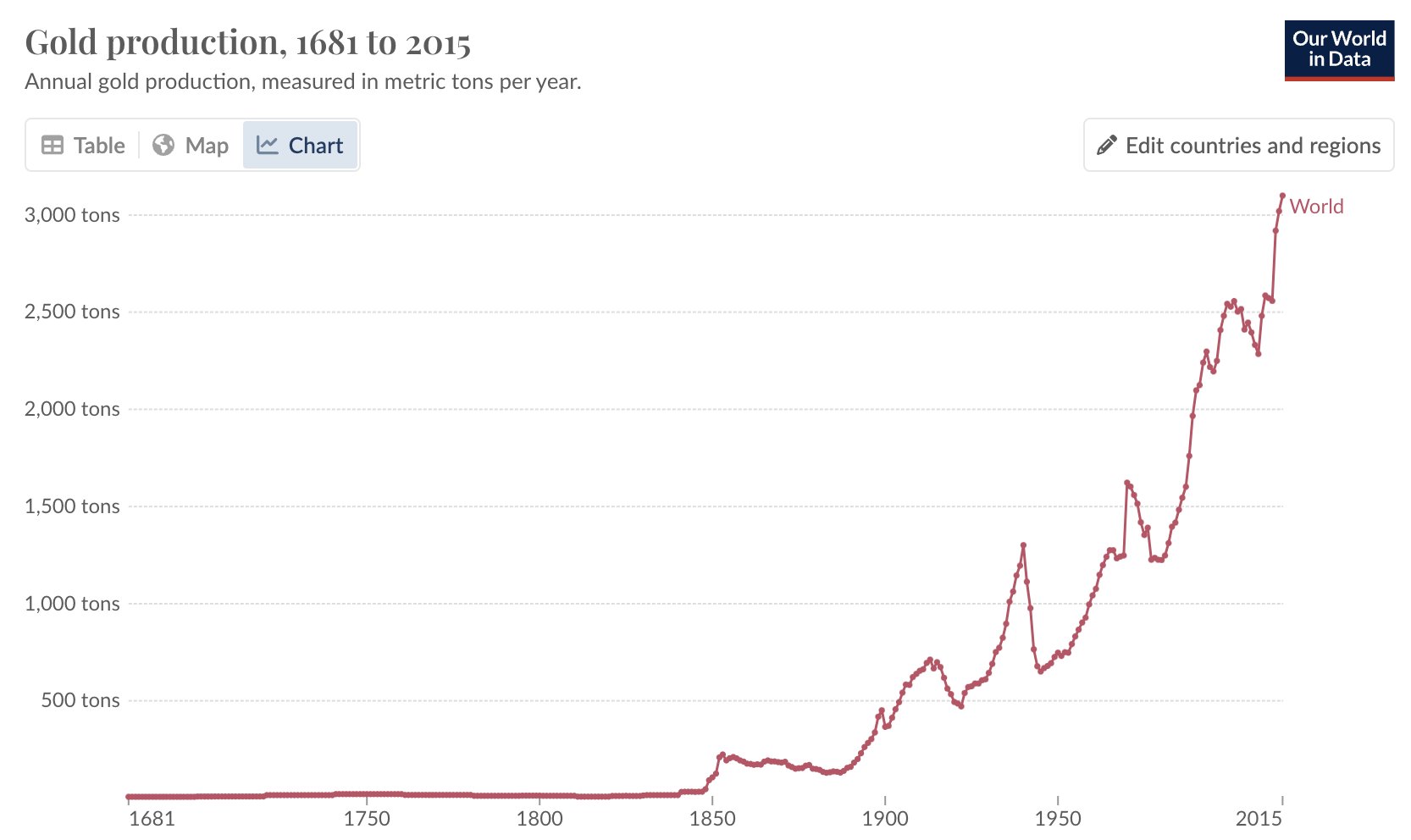

He shared a post on his X account, revealing a chart that shows gold’s mining progress as technology is improving.

He says that 213,000 metric tons are mined so far and there are 149 billion tons left to mine in the ground. He finished his post with a joke, saying that “we are still early.”

When someone asked Woo why his chart is almost a decade old, Woo responded that this is not his chart, but it’s from OurWorldInData.

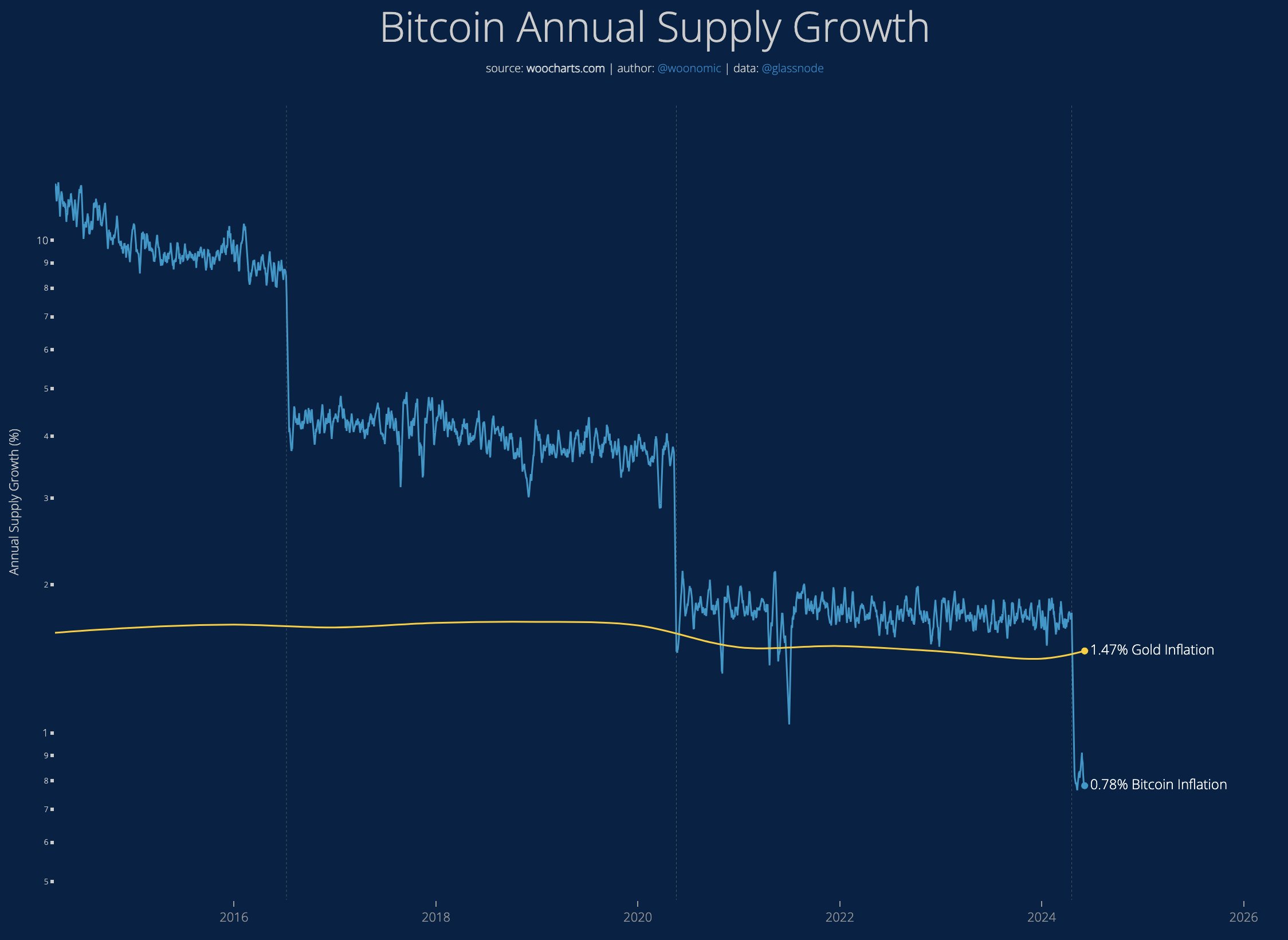

He also shared his own chart in percentage expansion for the last 10 years, up to date, via extrapolation of the last known annual mining rate from Dec 2023.

Woo’s chart shows a comparison between gold inflation and BTC inflation – 1,47% vs. 0.78%. BTC’s inflation is obviously dropping compared to the one of gold. The current inflation of BTC is about half of the one of gold.