Key Points

- Bitcoin is giving the same vibes as mid-2020.

- Despite low volatility, on-chain activity is high, with $1B added daily to new whales.

According to the latest reports, Bitcoin seems to be giving the same vibes as mid-2020.

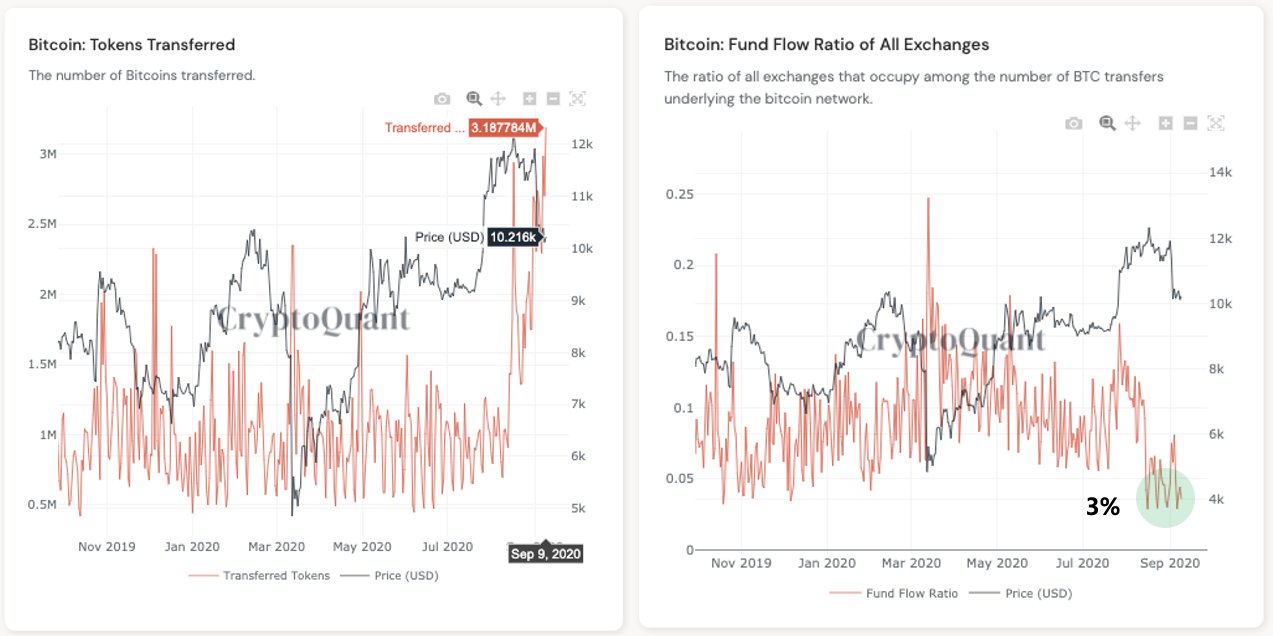

CryptoQuant’s CEO, Ki Young Ju notes via X that back in 2020, Bitcoin hovered around $10,000 for six months with high on-chain activity, later revealed as OTC deals.

He notes that now, despite low price volatility, on-chain activity is still high, with $1 billion added daily to new whale wallets, most likely custody.

Back in 2020, the number of BTC transferred hit a year-high, and the TXs were not from changes. Fund Flow Ratio of all exchanges hit a year-low, CryptoQuant’s CEO was posting back then.

Last time when this happened, BTC went from $10,000 to $69,000. There was also a period of accumulation between March and November 2021 before the price of BTC took off.

This time, it may happen sooner, according to the latest predictions, because Wall Street knows that the central bankers plan on taking the global economy.

While some people believe that fiat currency devaluation is bad news for crypto, this might be the point when we get to see the “Great Flippening.”

According to some traders, we have to separate crypto and fiat, as crypto cannot continue to derive its value from fiat currency. Some believe that people need to start demanding their employers pay them in some form of crypto and this way, they can choose to do whatever they want afterwards.

Bitcoin trades above $68k

At the moment of writing this article, BTC is trading above $68,000, up by almost 1% from the other day.

- Zoom

- Type

According to the latest predictions, BTC is set to end May on a positive note, but a larger battle continues. Despite reaching an all-time high of $73,800 three months ago, Bitcoin has not revisited those levels.

Recently, Keith Alan, co-founder of trading resource Material Indicators, has stated that Bitcoin must surpass its previous all-time high from 2021 to achieve a lasting breakout.