Key Points

- Bitcoin ETFs record $257 million in inflows on May 16, according to SoSoValue data.

- Bitcoin is trading above the important mark of $66k.

According to the latest reports coming from SoSoValue, Bitcoin ETFs recorded $257 million in inflows the other day, May 16. Here are the most important inflows in the US crypto products:

- Grayscale’s Bitcoin ETF, GBTC, had a net inflow of over $5 million.

- BlackRock’s Bitcoin ETF, IBIT, recorded a net inflow of over $94 million.

- Fidelity’s Bitcoin ETF, FBTC, saw a net inflow of over $67 million.

- Ark Invest and 21Shares’ Bitcoin ETF, ARKB, reported net inflows of $62 million.

The 11 spot Bitcoin ETFs in the U.S. have accumulated $12.40 billion worth of net inflows so far, according to the same data. Despite consecutive days of total net inflows, trading volume on the ETFs remains lower compared to the peak level in March.

Regarding Bitcoin‘s price today, at the moment of writing this article, BTC is trading above the important mark of $66k.

- Zoom

- Type

The CPI report landed two days ago, on May 15, and showed inflation eased to 3.4% in April from a year ago, which was in line with economist expectations. The results triggered a notable rise in BTC’s price on that day, of about 3%.

Bitwise CIO bullish on Bitcoin ETFs

According to the latest reports, the current week’s 13F filing revealed who has been buying Bitcoin ETFs and what their position size is.

Bitwise Chief Investment Officer Matt Hougan highlighted the success of the crypto products, saying that there is a significant point that the media might miss that is making him even more bullish on Bitcoin ETFs.

He said that 563 professional investment firms have reported owning a combined $3.5 billion worth of Bitcoin ETFs. He anticipates that this number will eventually surpass 700 firms with total assets under management nearing $5 billion.

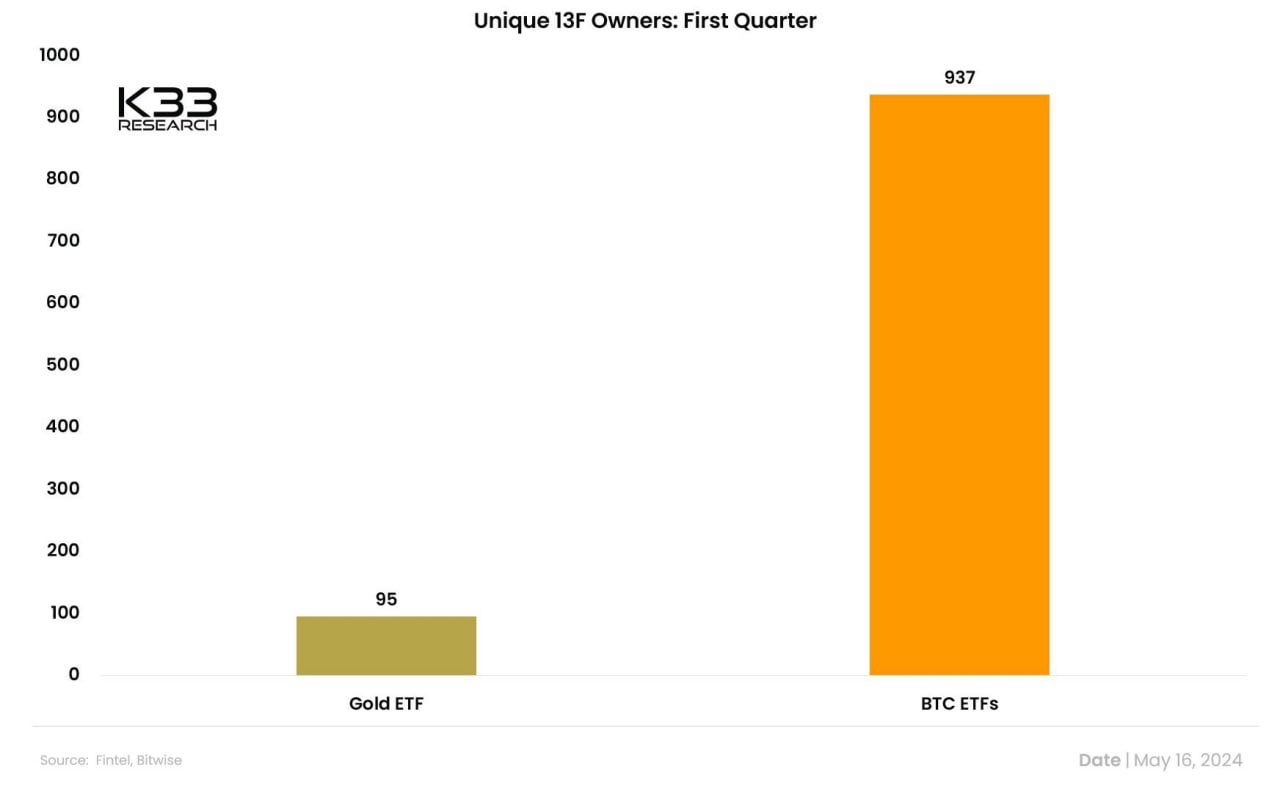

The latest data coming from K33 Research revealed that more than 900 firms disclosed investments in Bitcoin ETFs.

In a post on X from May 16, senior analyst at K33 Research Ventle Lunde said that according to the 13F reporting, 937 professional firms are invested in the US Bitcoin ETFs as of March 31.

He made a comparison with gold investments, which had 95 professional firms invested in gold in Q1 2024.