Key Points

- Bank of Japan raised interest rates for the second time in 17 years.

- The move holds significant implications for global markets.

New reports from Reuters note that the Japanese currency has sharply reversed course to hit a 7-month high on Monday.

According to the same reports, markets are focusing on BOJ Deputy Governor Shinichi Uchida’s speech on Wednesday for clues on the pace of future rate hikes.

The Japanese currency stood at 145.15 on Monday, according to the same notes.

BBC revealed today that there have been sharp falls across Asias’ markets. According to the latest reports, Japan’s Nikkei 225 dropped 12.4% or 4,451 points in the biggest fall by points in history.

BOJ Raised Interest Rates

The Bank of Japan has raised interest rates for the second time in 17 years and this has huge implications for the global markets.

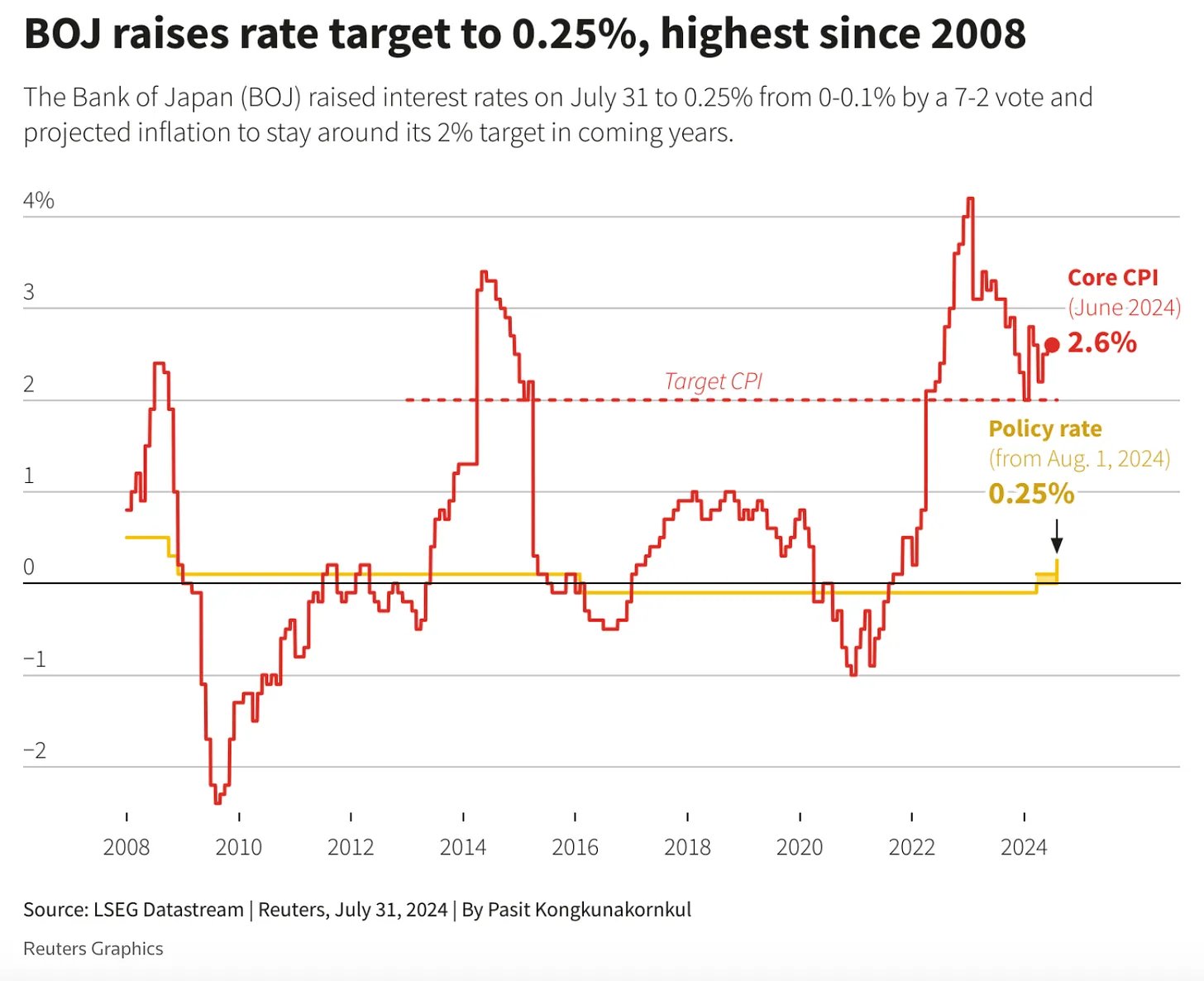

On July 31, in a surprise move, the Bank of Japan, hiked interest rates by 25 basis points. Markets were reportedly expecting a 10 bps increase, and this move caught them off guard.

A lot of traders and firms have leveraged the low borrowing costs in Japan to invest in higher-yielding assets elsewhere, especially in the US tech stocks.

As banking professor Wesley Kress notes via a post on X today, this strategy is known as the Yen carry trade and it’s facing severe pressure due to the increased cost of borrowing and the strengthening of the Yen against the US dollar.

Deutsche Bank analysts estimate this carry trade at a staggering $20 trillion.

In the same notes, he revealed that as traders unwind their Yen-denominated loans, the demand for Yen increases, strengthening the currency even more. This creates a cascading effect, forcing firms to liquidate their positions, which means that the market turmoil keeps amplifying.

The process is not an immediate one and could take weeks or even months to unfold completely, according to Kress.

Impact on Higher Risk Appetite Markets

This initial phase is reportedly impacting the ones with a higher risk appetite first, but the broader implications suggest a prolonged period of market distress.

The momentum of these reflexive dynamics means that as the Yen continues to strengthen, it will trigger further liquidations and demand for the Yen, creating a vicious cycle.

According to the same notes, given these dynamics, it’s prudent to prepare for a more significant downside in the markets. This situation could reportedly lead to one of the largest reflexive liquidations that the world has ever seen.

Patience and caution are advised as the full impact will take time to materialize.

The Kobiessi Letter shared a post on X, revealing the current global market situation, highlighting that Japan’s stock market posts its biggest 2-day drop in history.

According to them, along with the other declines in global markets, today’s drop will go down in history. Bitcoin, along with the crypto markets also saw significant declines today.