Key Points

- Prediction markets reveal only a 7% chance that the SEC will approve Ethereum ETFs this week.

- April Reuters reports also revealed that the US SEC is expected to deny the crypto products.

According to the latest reports coming from Matrixport, which cite prediction markets, there is only a 7% chance that the US SEC will approve the Ethereum ETFs this week.

The notes reveal that the derivatives markets are expecting an approximate 4.8% move in ETH by the end of the week.

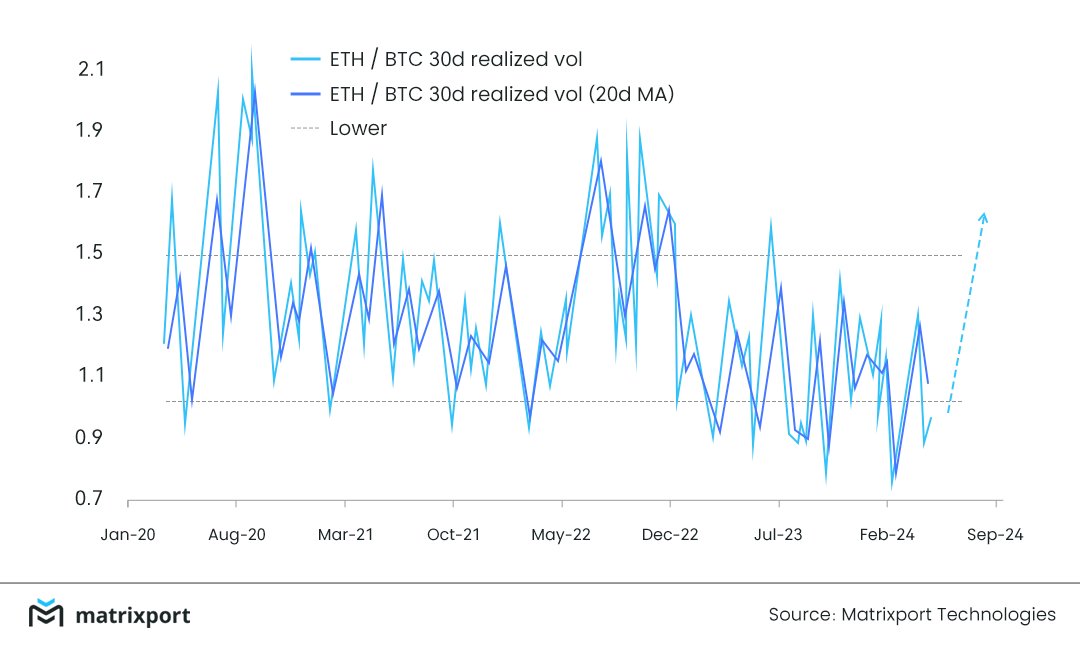

Historically, ETH volume has traded 30% on average, more than the BTC volume, but recently Ethereum has been even lower, despite normally being a higher beta asset. This has not been the case since this bull market started, notes Matrixport.

ETH volume appears cheap relative to the Bitcoin volume.

Back in April, reports from the Reuters press agency revealed that the US SEC could deny the spot Ethereum exchange-traded funds this month, citing sources familiar with the matter.

SEC to deliver its decision this week

US issuers and other firms were expecting to see the Securities and Exchange Commission denying their applications after some discouraging meetings with the regulatory agency.

VanEck, ARK Investment, and seven other issuers have previously filed with the SEC to list ETFs that would track the spot price of Ethereum.

The SEC has to decide on VanEck’s and ARK’s filings, which are the first in line, according to the same reports, by May 23 and May 24, respectively.

Last month, Reuters reported that the meetings between issuers and the regulator have been only one-sided, and the staff of the agency had not discussed important details about the proposed products.

Such a discussion landscape about ETH ETFs was different compared to the more intense and detailed talks that took place between the issuers of Bitcoin ETFs and the SEC during the weeks before the SEC decided to approve the crypto products at the beginning of the year.

Also last week, CNBC noted that the SEC could delay the decision on ETH ETFs due to a lack of an over-arching regulatory framework for all cryptocurrencies, according to Ric Edelman, head of the Digital Assets Council of Financial Professionals.

He told CNBC’s ETF Edge that a potential delay is not such bad news.

If the SEC declines the approval of ETH ETFs in the US, this would mean a drawback for the crypto industry in the country, and in the overall crypto world race, especially since Ethereum ETFs have been trading in Asian markets since last month.

Hong Kong approved the first batch of Bitcoin and Ethereum ETFs which started trading on April 30.

Regarding the price of Ethereum today, at the moment of writing this article, ETH is trading just a little above $3,000.

- Zoom

- Type

However, the coin is up by more than 4% in the past seven days, according to CoinMarketCap.